Notifications

JustTheFacts Max

JustTheFacts Max![]() -

December 6, 2021 -

Technology -

Federal Trade Commission

F.T.C.

ARM

Nvidia

-

3.2K views -

0 Comments -

0 Likes -

0 Reviews

-

December 6, 2021 -

Technology -

Federal Trade Commission

F.T.C.

ARM

Nvidia

-

3.2K views -

0 Comments -

0 Likes -

0 Reviews

By ‘JustTheFactsMax’

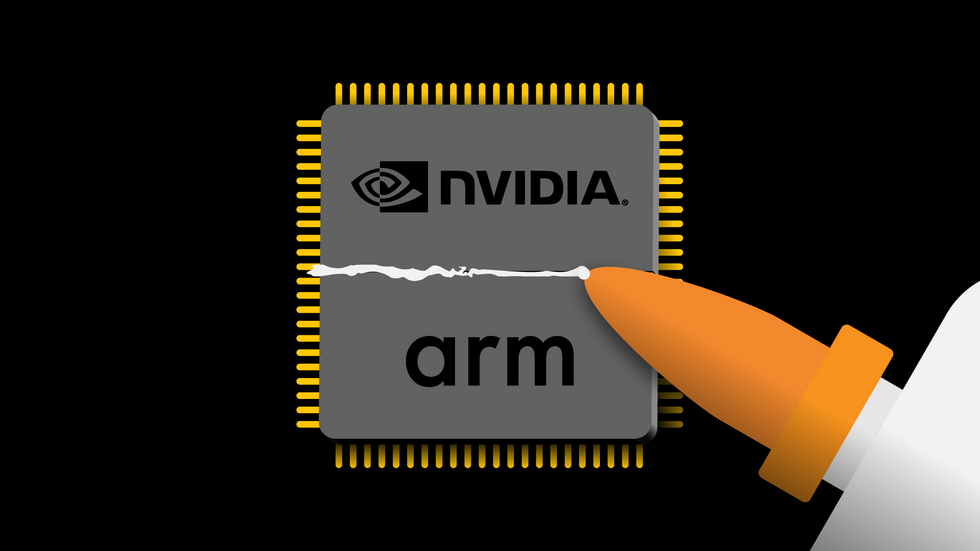

The Federal Trade Commission has filed a lawsuit against Nvidia and AMD over their proposed merger. The Commission argues that the combined companies would stifle competition in next-generation technologies and harm innovation. The F.T.C. cites complaints from Google, Microsoft, Qualcomm, and other tech companies. The companies already use Arm-based products, including graphics cards, CPUs, and networking products in datacenters. Whether the merger will affect innovation in these markets is unclear.

The F.T.C.'s decision to sue Nvidia to stop its historic deal with Arm is a blow to competition in the semiconductor industry. The F.T.C. has a long history of antitrust lawsuits, and this case is the latest example. While this one is much more controversial, the F.T.C.'s action has implications worldwide chipmakers. It may delay Nvidia's plan to enter the market by a decade or more.

The F.T.C. argues that the merger would reduce competition in the semiconductor chip industry. Because the two companies are closely aligned in technology, the merger would reduce their incentives to develop new products. Moreover, the merged company would have fewer incentives to create valuable features or enable innovations that harm competitors—the complaint names Nvidia Corp. and Arm Ltd., along with its owner, Softbank Group Corp. The case will proceed to administrative trial, and any ruling will be final by August 20, 2022.

The merger between Nvidia and Arm has already received scrutiny from regulators in Europe. The deal was first announced in May. However, Britain's Competition and Markets Authority opened an in-depth investigation of the deal in November. The regulators cited national-security concerns and competition concerns. The F.T.C. also claimed that the merger would provide Nvidia with sensitive information about competitors. As a result, the Commission's four commissioners unanimously voted to block the merger in February. A full complaint has not yet been released, but the case is expected to go to an administrative trial on May 10.

The deal is also controversial in the semiconductor industry. The merger between Nvidia and Arm would give the combined company control over rival technology. The F.T.C. contends that the merger will hurt competition in markets where Nvidia products and Arm's designs are used in autonomous cars, data centers, and cloud computing. European and U.K. regulators have already criticized the deal.

The F.T.C. has argued that the merger would undermine competition in the semiconductor industry. By enforcing antitrust laws, the F.T.C. has the power to prevent the union from taking place. By suing, the F.T.C. aims to protect consumers and protect the interests of consumers. If the merger occurs, the government would be forced to halt the deal and prevent Nvidia from using its exclusive technology in future products.

The proposed merger is a significant concern for the technology industry. The merger would eliminate competition, which would cause prices to go up. The F.T.C. is also concerned about the impact on the global economy if the deal takes place. In addition, the F.T.C.'s recent appointment of Lina Khan, a noted critic of Big Tech, raises antitrust concerns. Finally, the merger of the two companies could result in the F.T.C. targeting Amazon(AMZN).

The Justice Department believes that the proposed merger could harm competition in the semiconductor industry. Despite the F.T.C.'s concern, Nvidia has expressed commitment to maintaining its open licensing policy. In addition to preventing antitrust lawsuits, the company will invest in R& D at Arm. It will also increase its access to Arm's designs. Its goal is to ensure a competitive ecosystem.

The suit aims to curb corporate concentration and increase competition. The lawsuit claims that the acquisition will harm the competition by giving Nvidia access to the sensitive information of Arm's licensees. In addition, the F.T.C. wants to protect consumers by preventing corporate mergers that will hamper innovation. Its actions would also make it more challenging to compete with other firms in the semiconductor industry.